You may be liable to tax on your previously exempted investment income effective from 2 January 2022 - Tax & Business Matters - Nigeria

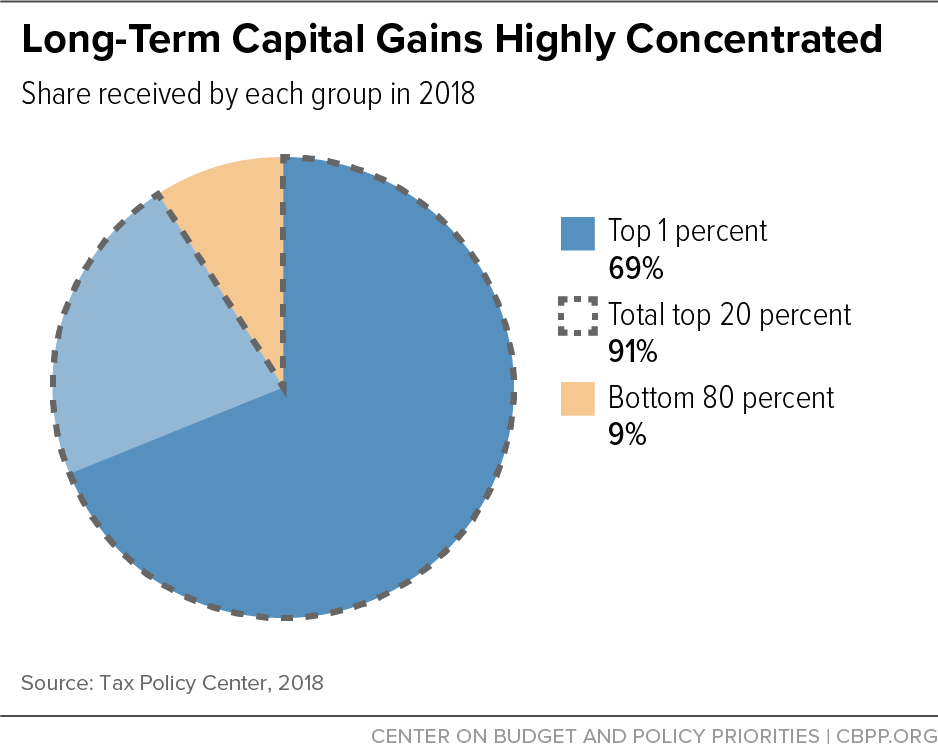

Substantial Income of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks | Center on Budget and Policy Priorities

Federal Inland Revenue Service NG on Twitter: "31st JULY, 2018 is the DUE DATE for filing the following Tax Returns: For companies having 31st January, 2018 as Accounting Year End; 1)Companies Income

Capital Income Tax - TAX Questions and answers... 909-574-1737 QUESTION: Can you process my taxes even though I live in Florida, North Dakota, Utah, Nevada, Wyoming, Indiana, Texas, Michigan, Missouri, Georgia, Oregon,

Federal Inland Revenue Service NG on Twitter: "31st MARCH, 2018 IS THE DUE DATE OF FILING THE FOLLOWING TAX RETURNS: I. Personal Income Tax (PIT) for 2018. II. For companies having 30th

Deloitte - DELOITTE SCHOOL OF TAX Corporate Income Tax (CIT) Masterclass Date: 21st - 22nd April, 2021 Time: 9:30 am - 2:00 pm each day Fee: Ghc1500 per participant Training Registration Link:

Federal Inland Revenue Service NG on Twitter: "30th JUNE, 2018 is the DUE DATE for filing the following tax returns: For companies having 31st December, 2017 as Accounting Year End 1) Company